tax type stsl component|Study and training support loans : Cebu You must withhold the study and training support loans component from all your employee's earnings, including taxable allowances, bonuses and commissions. Example 1. Employee has claimed the tax-free threshold and has weekly earnings of $1,095.84. . Odds.ph is your favourite guide to the best sports betting sites that allow Philippines to bet on sports online. Odds.ph offers Philippines an all-encompassing guide into betting on sports. You can find the best Philippines sports betting websites that feature the best odds and a generous bonus to go with it. Betting on sports has never been .

tax type stsl component,You must withhold the study and training support loans component from all your employee's earnings, including taxable allowances, bonuses and commissions. Example 1. Employee has claimed the tax-free threshold and has weekly earnings of $1,095.84. .Use this tax table for payments made from 1 July 2022 to 30 June 2023. You can use .Types of loans. You can find a number of loans available from the Australian .

Best answers (2) Hi everyone, aware that this discussion is pretty trendy we thought it'd be good for us to pop in on this one to confirm too. Just as noted, 'STSL' stands for Study .Use this tax table for payments made from 1 July 2022 to 30 June 2023. You can use the Study and training support loans component lookup tool (XLSX 24KB) This link will .tax type stsl componentcomponent from all your employee’s earnings, including taxable allowances, bonuses and commissions. Examples 1 Employee has claimed the tax-free threshold and has weekly .Manual tax adjustment on STSL is through Schedule 5 but Schedule 5 is for back payments, commissions, bonuses and similar payments. It's not for upward variations. .Weekly equivalent of $5,488.45 = $1,266.99 ($5,488.45 × 3 ÷ 13, ignoring cents and adding 99 cents). Weekly STSL component = $1,266.99 × 3% = $38.00 rounded to the nearest .Fortnightly STSL component = $48.00 ($24.00 x 2). Example 3 – monthly earnings. Employee has claimed the tax-free threshold and has monthly earnings of $5,488.45. .Types of loans. You can find a number of loans available from the Australian Government to help you complete further training and study. . How and when compulsory .Inventory on Hand on Item List does not match Adjust Quantity/Value on Hand form. Effective from the 1st of July 2019 the Australian Taxation Office (ATO) combined the .The amount used when calculating the STSL amount in a pay run depends on the pay run's frequency. You can access the ATO STSL tax tables here based on the applicable .

Tax scale type (Australian resident) Determines the amount of PAYG withheld each pay. Regular: PAYG calculated based on relevant tax table, eg monthly, fortnightly, weekly. . If an employee earns over the relevant threshold for their loan, an STSL component will be withheld in the pay run based on relevant repayment rates. Tax-free threshold:

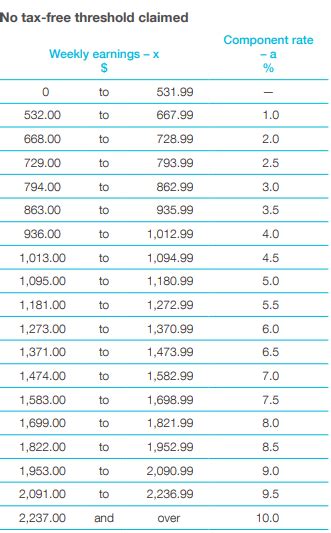

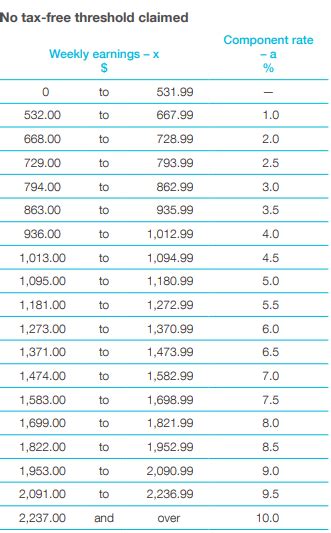

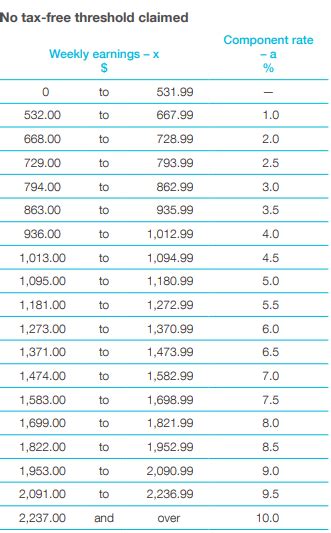

There are two ways of doing this: You can add this an an upwards variation in the employee's Taxes tab and let the ATO know. You can add a Manual Adjustment - STSL Component on Schedule 5 directly in the pay run (please note, it's not possible to add this in the Pay Template so you'll need to add this in the payslip each pay period). . What is Study Training and Support Loans(STSL)?The government provides financial assistance (in the form of loans) like STSL to people undertaking higher education, trade apprenticeships and other training programs. Information on the different type of loans that fall into the STSL category can be found here. From 1 If your employee has not claimed the tax-free threshold, the study and training support loans component is calculated on earnings of: $546 or more if paid weekly; . Weekly STSL component = $1,266.99 × 3.5% = $44.00 rounded to the nearest dollar. Monthly STSL component = $191.00 ($44.00 × 13 ÷ 3, rounded to the nearest dollar).

Tilly Chamberlain Xero. February 6, 2024 at 11:03am. Hi Anne, It's not possible to record the additional contributions that will display as STSL component on a payslip. When the 'Upwards Variation Requested' option is selected in the Taxes tab, this can not be marked as STSL so it'll need to be communicated to the ATO when it is paid .

Hi @SamanthaLS, If you have earnt under the repayment threshold then no. Unless you have deduction arrangements (withholding declaration) with your employer as part of your usual pay. You can read more about parental leave & related entitlements and parental leave pay. Hope this helps! Provide feedback.

Do I pay STLS while .

For example, in February we paid commission $4xx to employee A, and there is tax withheld on STSL component on schedule 5 for $48. Then next month in March, $0 tax withheld on STSL component on schedule 5 despite commission paid on that month is $500, but there was PAYG on schedule 5. Next month April, $9xx commission and there .Why do I have a deduction on my payslip called ‘STSL Amount’? Updated 22/07/2021 04.11 PM. This amount is the repayment deducted for study and training support loans, which includes HECS, HELP, and VET FEE-HELP repayments.

tax type stsl component Study and training support loans When you lodge a tax return, we will consider all other income outside salary and wages earned by the employee during the financial year when determining the total STSL amount. Because it can often be challenging to keep track of all other income during the financial year, an employee may choose to add a buffer to the STSL amount .Study and training support loans Tax (3): Next comes tax. This section, which usually says PAYG will lay out how much tax has been automatically deducted from your payslip by your employer. . Just a heads up: You might have an STSL (Study and Training Support Loans) component here too if you’ve got a student loan such as HELP or HECS. .Inventory on Hand on Item List does not match Adjust Quantity/Value on Hand form. Effective from the 1st of July 2019 the Australian Taxation Office (ATO) combined the tax scales of several educational assistance . The additional tax withheld is not applied to your loan account until: you have lodged your tax return, and; a compulsory repayment has been calculated based on your repayment income. Find out about Types of loans. For more information see: Tax file number declaration (NAT 3092) Withholding declaration (NAT 3093) Tax in Australia: . Then use the appropriate column to find the study and training support loans component: use column 3 if your employee is not claiming the tax-free threshold. Example – using the lookup tool. The employee has claimed the tax-free threshold and has fortnightly earnings of $2,774.00. Ignoring cents, input $2,774 into column 1 in the Study and . Most payroll software uses STSL. How it works is that your employer withholds extra tax from your pay each payrun. Then when you lodge your tax return and we can work out the exact amount you need to repay, it's charged on your income tax return. Check your notice of assessment - you'll see it listed.

EthanATO (Community Support) 31 July 2021. Hi @AaronYeaman, STSL is simply a payroll code some employers include on their payslips to let you know how much extra tax they've withheld. This extra tax is treated the same as all the other tax they withhold and is used to cover all your tax liabilities, which includes your HELP debt.

EthanATO (Community Support) 31 July 2021. Hi @AaronYeaman, STSL is simply a payroll code some employers include on their payslips to let you know how much extra tax they've withheld. This extra tax is treated the same as all the other tax they withhold and is used to cover all your tax liabilities, which includes your HELP debt.STSL component tax help. Save. This thread is archived and may not be up-to-date. You can't reply to this thread. Author: Balakay_95 (Newbie) 14 July 2022. . I had a look at my tax and calculated my return and I'm expected to get less then 3k returned when my my STSL component is sitting at 4.8k. I tried and had a look everywhere and I can't . 2%. $68,603 – $97,377. 3%. $97,378 and above. 4%. QC 16176. Print or Download. See the repayment thresholds and rates for the compulsory repayment of study and training support loans. My HECS is sitting on $ 51,255.54 before Indexation on June 2022. I work full time and has STSL Component deducted on my pay weekly. By end of financial year, $2,447.00 has been put through for STSL, and when I filed my tax return with my accountant, I had to pay 3.5% of my gross.

tax type stsl component|Study and training support loans

PH0 · When to work out the study and training support loans component

PH1 · When to work out the study and training support loans

PH2 · What does STSL Component stand for in Xero Payroll from 1/7/2019

PH3 · Understanding STSL tax: its impact and importance in Australia

PH4 · Study and training support loans monthly tax table

PH5 · Study and training support loans (STSL)

PH6 · Study and training support loans

PH7 · Statement of formulas for calculating study and training support loans

PH8 · Statement of formulas for calculating study and training support

PH9 · Manual tax adjustment on STSL component – Xero Central

PH10 · How is STSL calculated in the pay run? – Your Payroll (AU)